Use these steps to add your business or self-employment income - the eFile App will generate Schedule C for you so you do not need to fill in this form line-by-line manually. eFile will calculate your Self-Employment Taxes via Schedule SE and reduce them by also calculating your Qualified Business Income (QBI) Deduction.

2. Navigate to the Business Section

You will arrive at the income section as you work through the tax interview where you will first be asked about W-2 income. Add this income if applicable before proceeding through the remaining sections. To quickly navigate the business section, select Federal Taxes > Income > Business.

3. Declare Your Business

Select that you have a business to add and enter your details - you must select that this is for a business so Schedule C and Schedule SE can be generated. This applies if you own a business or you do freelance work; for tax purposes, you own your own business if you do freelance work. If you do not select that this is for a business, the IRS may contact you to correct this so you can pay self-employment taxes.

4. Enter Income, Deductions, and Other Expenses

As someone who is self-employed, you are able to add your income earned for the business as well as expenses you had that relate to your business. You can add income which you did not receive a tax form for and income you received a 1099-MISC or 1099-NEC for. Deductions for expenses are added lower on the page; some items, like vehicles and mileage, are added later.

5. Deductible Expenses

Don't overlook these tax savings! Be sure you work through the entire business interview so you do not miss any deductible expenses. For example, depreciation and vehicle mileage or use are entered toward the section's end.

6. Additional Information

Once you finish, eFile will have generated your Schedule C and Schedule SE - you can see your return at any point under My Account by opening the PDF return in progress.

See more

details on self-employment income.

7. Add Forms Manually

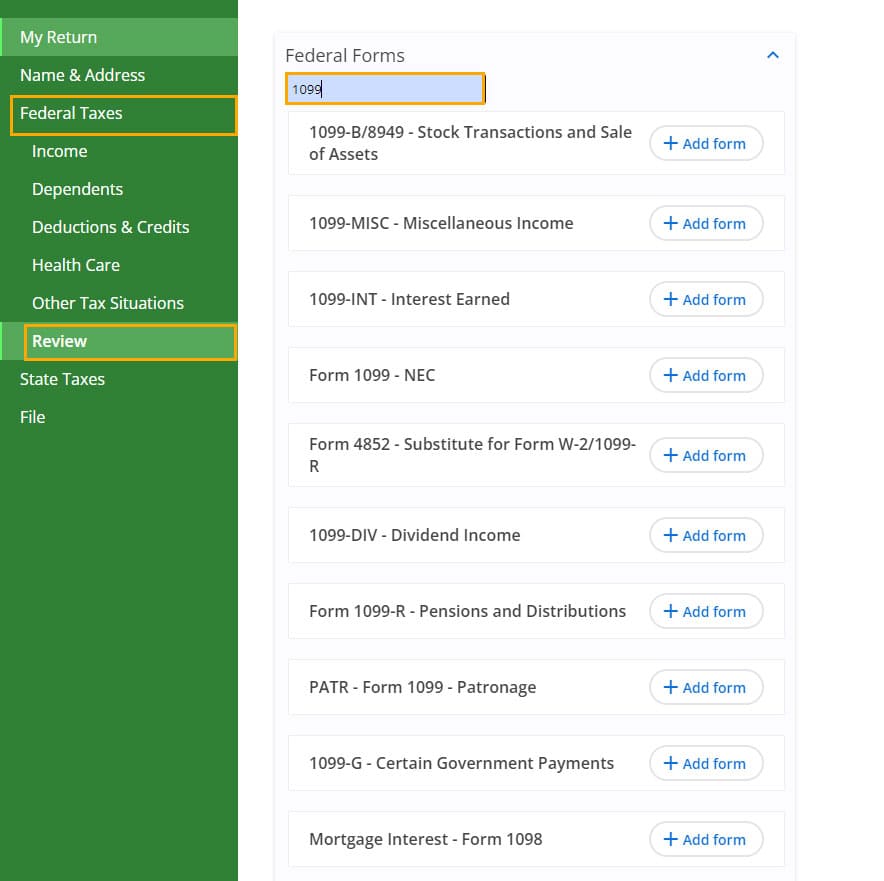

If you want to manually add forms, you can add a 1099-MISC or 1099-NEC by selecting

Federal Taxes/Review on the left menu. Here, select

I'd like to see all federal forms and enter

“1099

” and both the 1099-MISC and 1099-NEC will be shown in the results among other 1099 forms. Add the respective form for your income by clicking the "+ Add form" button and work through the questions. If you are self-employed, click on

I'd like to tell you about my business and proceed through the tax questions and provide your information.